are union dues tax deductible in ny

Union Dues are Tax Deductible Thursday January 24 2019 Two years ago the New York State AFL-CIO with support from unions across the state. As a result of legislation championed by NYSUT the state AFL-CIO and unions across the state which was passed and signed into law.

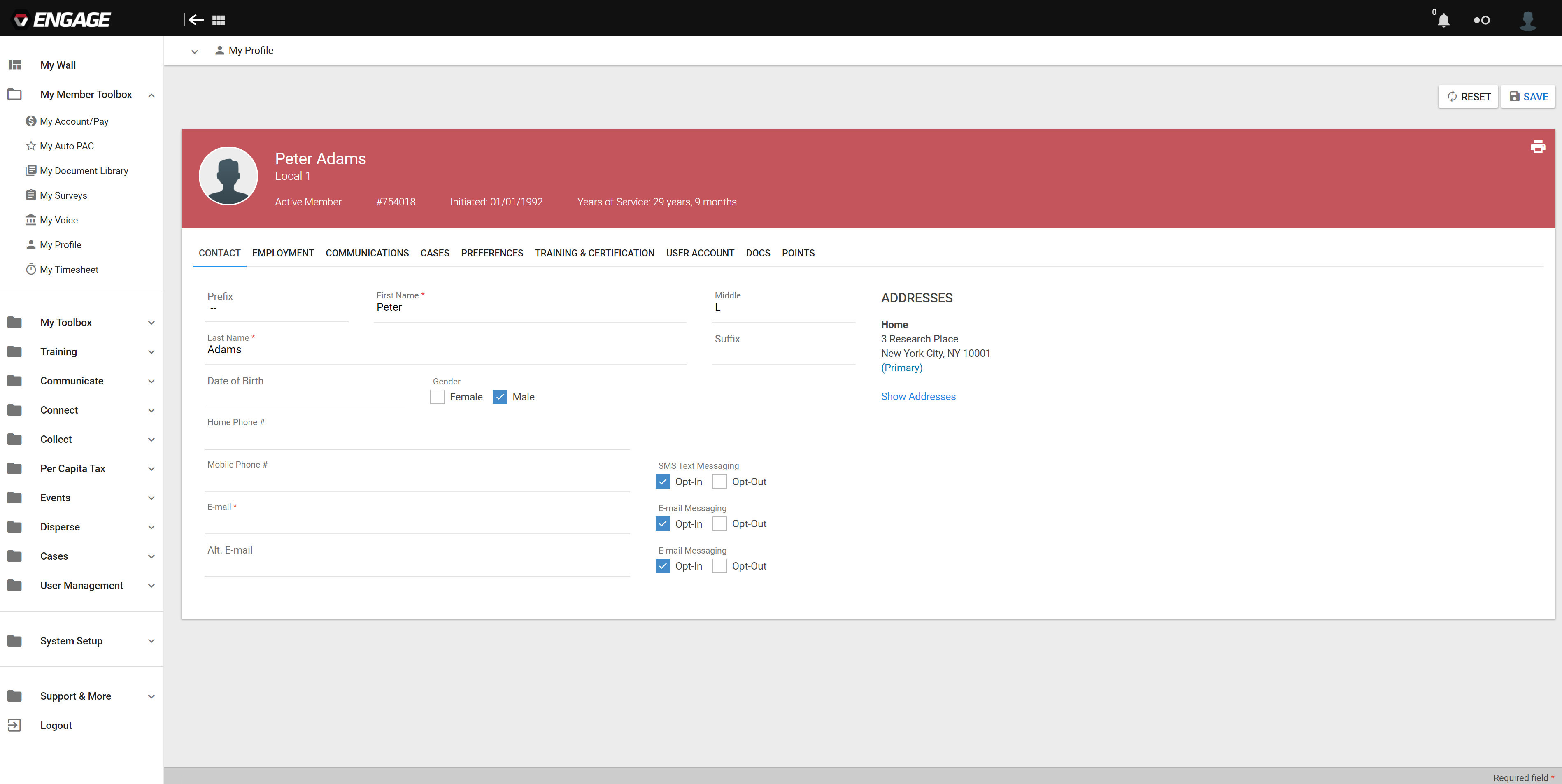

Uniontrack Engage Union Software Union Membership Director Benefits

New Yorks highest-paid union workers will be the chief beneficiaries of a tax break slipped into the state budget that makes their dues fully tax-deductible an analysis has found.

. Just a reminder that as you complete your tax forms for New York State if you itemize your tax deductions be sure to include your. In the new state budget agreement unions lobbied for and won a provision that will allow private- and public-sector union members to deduct the cost of their union dues from their New York. California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through.

In a first of its kind move New York law makers have made union dues fully tax deductible. If your Standard Deduction. State tax deduction for your union dues.

Reminder Union Dues are Tax Deductible. Four years have passed since union dues havent been deducted from federal taxes and many lawmakers are attempting to bring it back and make it deductible without itemizing. Let Your Accountant Know.

No employees cant take a union dues deduction on their return. My apologies I think I misinterpreted your initial question. Union dues will be entered into the Federal portion of TurboTax and then they will automatically transfer over to.

For federal purposes your total itemized deduction for state and local taxes paid in 2021 is limited to a combined amount not to exceed 10000 5000 if married filing. The FY 2018 Enacted Budget creates a union dues deduction for New York taxpayers who itemize deductions at the state level equal to the amount currently disallowed at the federal level due. The new measure was signed by New York Governor Andrew Cuomo.

Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp Thanks to new legislation union members can now deduct their union dues in full from their. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business. Unfortunately while union dues are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return.

Union Dues Do Not Here Reduce Income For C S S A Purposes Divorce New York

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Deductions Are Now More Limited The New York Times

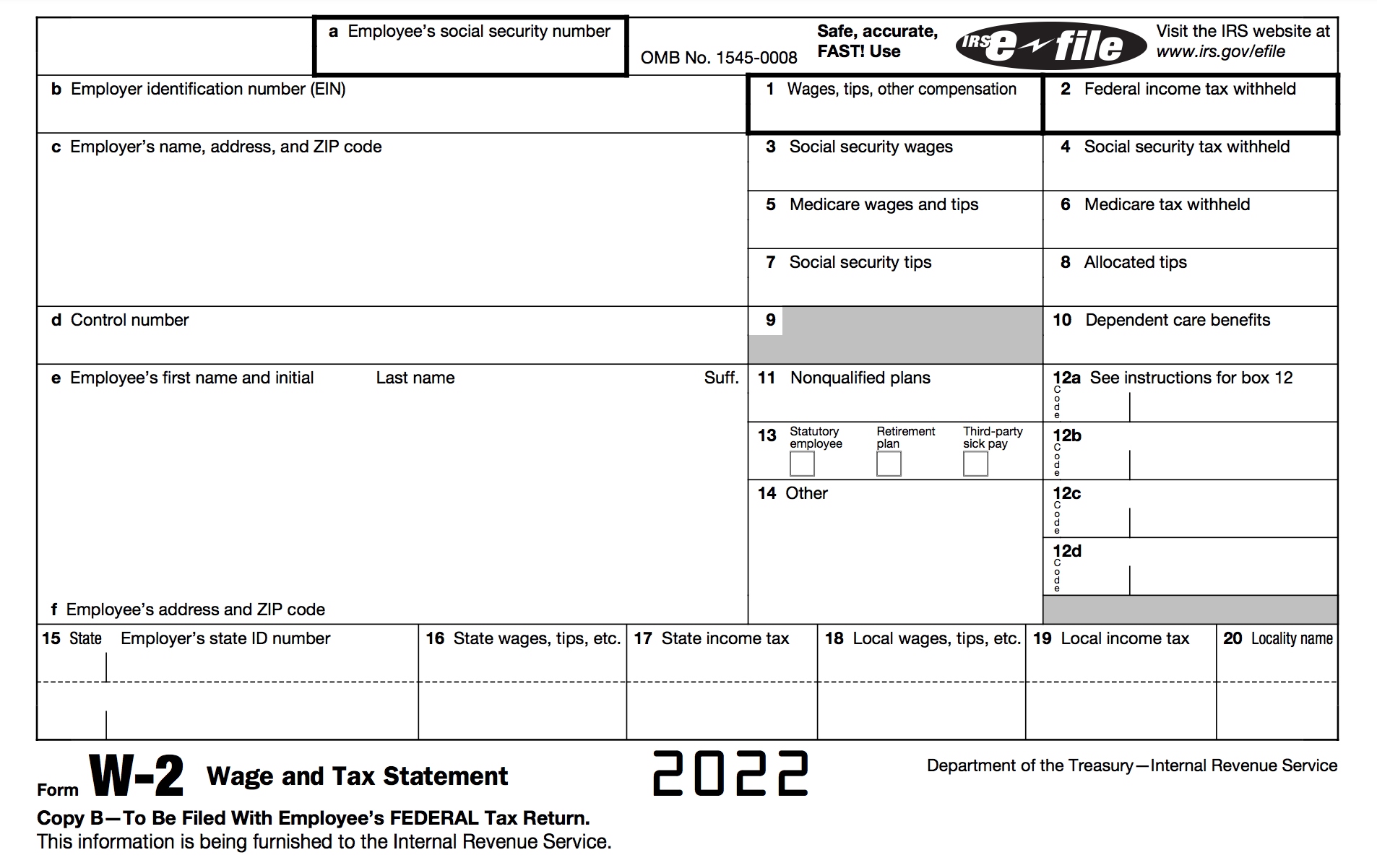

How To Fill Out A W 2 Tax Form For Employees Smartasset

Governor Cuomo Signs Legislation Allowing Full Union Dues To Be Deducted From New York State Taxes New York State Afl Cio

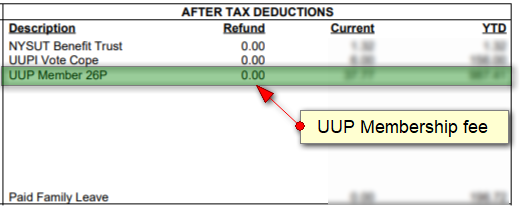

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp

Hey Union Dues Are Now Tax Deductible Lut Levittown United Teachers

Tax Relief For Employees Work Expenses Should Not Be Limited To Union Dues

Dues Fully Deductible From State Taxes

Dues Check Off Provisions Once Again Expire With Cba Nlrb Rules Barnes Thornburg

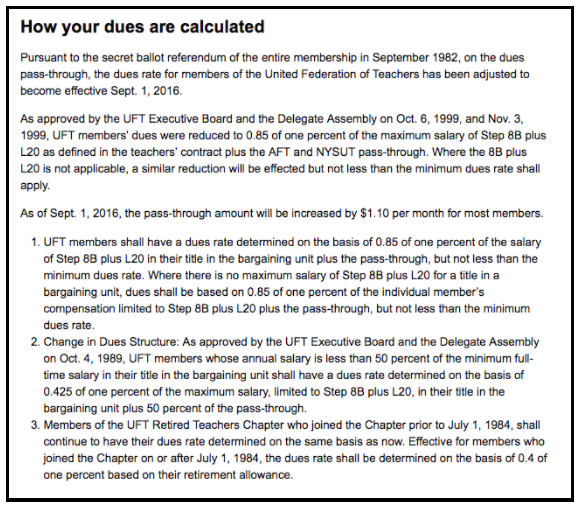

Nyc Teachers Union Sows Confusion As It Delivers Raises Double Dips On Dues The 74

Deducting Union Dues Drake17 And Prior

Home Union Alsacienne Of New York

The Wandering Tax Pro What S New For 2018 Tax Forms New York

California Taxpayers Could Subsidize Union Dues In Future Budget Years California Thecentersquare Com